It’s been billed as the great flat tax “revolution.”

In the last two years, five states – Arizona, Iowa, Mississippi, Georgia, and Idaho – have moved from a graduated income tax rate to a flat individual income tax.

Since 2021, the number of states with flat income tax structures on the books has climbed from eight to 13.

Massachusetts had a flat tax but voters last year amended their constitution to increase taxes for millionaires.

At the start of this year, Republican Gov. Doug Burgum of North Dakota called on lawmakers to adopt the lowest flat tax rate in the country, saying his plan would wipe out income taxes for three out of five taxpayers.

Now, the debate is moving to Kansas with two influential conservative groups – the Kansas Chamber of Commerce and Americans for Prosperity – urging a Republican-dominated Legislature to move to a flat tax.

“It really is something unique that we’ve seen in the past couple of years,” said Katherine Loughead, a senior policy analyst for the conservative-leaning Tax Foundation.

“States have more revenue on hand now in a lot of cases than at any other time in their history,” Loughead said.

State revenues continued to grow during the pandemic despite fears that it would send them into an economic tailspin, she said.

“Most states have continued to remain on a strong, upward growth trajectory,” she said.

“Now we’re in a position where a lot of states are looking for ways to return that revenue to taxpayers in a way that will not just give them relief now, but will promote long-term economic growth in their state,” she said.

The idea of moving away from Kansas’ three-tiered structure for personal income taxes was also part of the Republican agenda that lawmakers rolled out at the start of the session.

“We want some something flatter, fairer and lower for our constituents,” Senate President Ty Masterson said.

Supporters of the flat tax says it’s simple, fair and promotes growth. Opponents say it hurts low-income earners while benefiting more wealthy taxpayers.

Democratic state Rep. Tom Sawyer, ranking member on the House tax committee, said a flat tax would disproportionately hurt those who are not as wealthy.

“It’s a basic fairness question,” he said.

“What we’re doing is going to raise taxes for people who are living paycheck to paycheck,” he said.

“They’re going to pay a little higher in income taxes just so we can give wealthy people a big tax cut,” he said.

Supporters of a flat tax proposal believe it can be drawn up in a way so it doesn’t put low-income earners at a disadvantage.

“Lower rates for all is the goal,” said Elizabeth Patton, state director for Americans for Prosperity.

“There is absolutely a way to make certain that we right-size the Kansas tax code so that every single Kansan has a lower, simpler rate,” Patton said in an email.

The flat tax would be a significant departure from Democratic Gov. Laura Kelly’s proposal to accelerate elimination of the state sales tax on food, create a sales tax holiday for school supplies and cut taxes on Social Security income.

Kelly has urged the Legislature to adopt a tax plan that was “responsible,” not something that would throw the budget into disarray.

Kelly in a recent interview expressed reservations about a flat tax and what it might mean for low-income earners in Kansas.

“I don’t know that the flat tax is so much irresponsible as incredibly regressive and unfair,” Kelly said in an interview with the Sunflower State Journal.

“I’ve always seen the flat tax as regressive,” she said. “I am not enthusiastic about it.”

A bill calling for a flat tax has not been introduced yet, but it is anticipated to include a flat rate for corporate taxes and possibly a reduction in rates if revenues exceed estimates similar to a law enacted in North Carolina.

Last year, lawmakers gave a preview of what a bill might look like with legislation that would have established a 4.75% flat tax for individuals.

The bill would have eliminated the three income tax brackets now in place for individuals.

Individual income tax rates are now set at 3.1% for earnings under $15,000 or $30,000 for married couples filing jointly.

The rate is 5.25% for income between $15,000 and $30,000 or $30,000 to $60,000 for married couple filing jointly.

Earnings are taxed at 5.7% for income of $30,000 or more for individuals and $60,000 or more for married couples.

Last year’s bill moving the state to a flat tax rate of 4.75% would have cost $502 million over three years, about the same amount that Kelly is proposing to cut taxes.

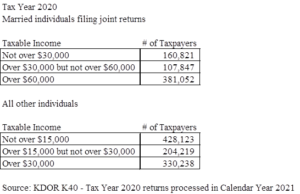

There were about 161,000 married taxpayers who filed joint returns in 2020 and earned less than $30,000 a year in taxable income, according to data obtained from the Kansas Department of Revenue.

There were about 428,000 individuals who made less than $15,000 a year who filed returns in 2020, state data show.

By comparison, there were about 381,000 married taxpayers who filed joint returns in 2020 and made more than $60,000 a year, according to state data.

And there were about 330,000 individuals who made more than $30,000 a year who filed returns in 2020, according to state data.

The battle over taxes comes with the state projected to have a $2.3 billion ending balance at the end of the current fiscal year.

“While the chamber supports lowering the sale tax on food, we would prefer an overall lowering of the state sales tax that doesn’t carve out reductions for specific things like food and sales tax holiday for school supplies,” said Eric Stafford, the chamber’s vice president of government affairs.

“The bottom line is state receipts are way up,” Stafford said. “It’s time to lower rates, and let’s try to get that accomplished.”

Critics say the flat tax would effectively raise taxes for Kansans who earn less than the flat tax amount and lower taxes for those who make more than the amount.

Kansas Action for Children called the flat tax an “inequitable policy that will hurt low- and middle-income Kansas families.”

“Average Kansans will pay more while the wealthiest get tax breaks they do not need,” said Emily Fetsch, director of fiscal policy for Kansas Action for Children.

Republican state Rep. Adam Smith of Weskan said he likes the idea of a flat tax but doesn’t want to raise taxes on Kansans in a lower tax bracket.

“Whether a tax rate is equal, progressive or regressive is kind of in the eyes of the beholder,” Smith said.

“I think (with) a flat rate, the more you make, the more you pay in taxes,” he said. “A flat rate makes sense to me.”

Loughead said a bill could be written in a way so it doesn’t raise taxes.

She said the state’s three tax brackets could be consolidated into one while lowering the rate and increasing the standard deduction.

Loughead said if the flat tax rate was set at 5% in Kansas and the standard deduction was increased to $10,000, a taxpayer making $30,000 would save $63 in taxes.

“That might not seem like a ton of tax savings in any given year, but a lower rate means they’re able to keep that money not just this year, but in future years,” she said.

“As their income trajectory and potential grows in future years, they’re still going to enjoy those tax savings,” she said.

.