(Will be updated after 8:30 a.m. conference committee meeting)

Kansas lawmakers will return to work Wednesday after meeting into the night Tuesday trying to iron out a plan to cut taxes as this year’s legislative session winds down.

A House-Senate conference committee is expected to resume negotiations at 8:30 this morning over a tax bill that could potentially cost hundreds of millions of dollars depending on what legislators agree on before the session ends.

Where the negotiations are headed is unclear.

There are just three days left in the legislative session. The House and Senate are butting heads over not only the size of any tax cut, but whether they state can even afford one after lawmakers just passed a five-year, $525 million education plan in response to a state Supreme Court ruling.

Senators have been pushing an expansive plan that includes some of the major components of a half-billion dollar tax cut that it approved last month. The Senate passed its plan on a 24-16 vote.

The House has resisted the size of the Senate proposal even though top leaders believe the state should return any windfall it might receive as a result of federal tax reform.

However, they believe the margin for error is small since there was barely enough room in the budget to fund an education plan let alone adding in millions more in tax cuts.

Financial profiles already show the state exhausting its reserves by 2021 and that’s counting about $450 million in new revenue from the changes in the federal tax code. Subtract that money and the state would be in the red by 2020.

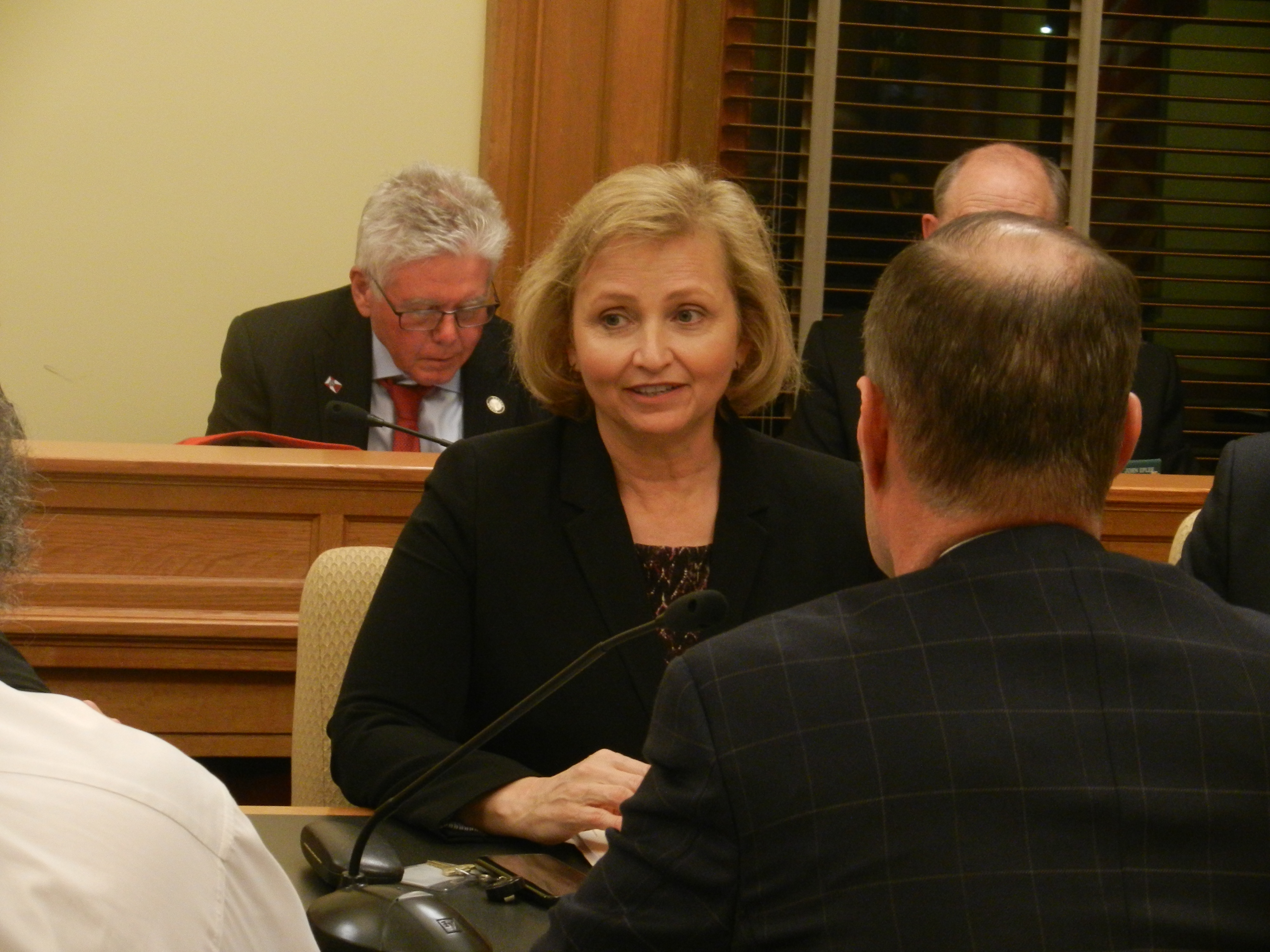

Republican state Sen. Caryn Tyson, the Senate’s lead tax negotiator, has been pushing hard to reach an agreement.

She believes it’s imperative for the state to return any windfall it might receive from changes in the federal tax code. She doesn’t believe the state should use a change in the federal tax code to grow government.

Tyson, a candidate for Congress, was willing to meet into the early morning hours after midnight Wednesday to hash out a tax agreement.

“We need to move,” Tyson said. “The clock is ticking. We all know D-Day is May 4.”

At one point, Tyson seemed upset that House tax negotiators didn’t meet earlier in the day when a meeting scheduled for 5 p.m. was held at 9 p.m. instead.

“We’re just not very good at the faith right now,” Tyson said. “I want to get that faith back.”

The sheer magnitude of the Senate tax proposal is making House members – mindful of the fallout from the 2012 tax cuts – nervous.

The Senate’s tax bill would allow Kansas taxpayers to continue itemizing on their state return even if they don’t itemize on their federal tax return, something that will be less likely since Congress doubled the federal standard deduction.

They also want to add language to the tax bill that would effectively decouple the state from changes in the federal tax code that could cost multinational corporations millions in taxes on money made overseas that’s returned to the United States.

The most costly part of the Senate plan, however, may be an effort to increase the standard deduction by 25 percent.

Raising the standard deductions – to $3,750 from $3,000 for single filers and to $9,375 from $7,500 for married couples filing jointly – would cost the state about $285 million over five years, according to fiscal estimates.

They also want to speed up the restoration for itemized deductions for medical expenses, mortgage interest, and property taxes on the state return.

Under current law, those deductions would be phased in from 2018 to 2020. Senators want to allow taxpayers to claim 100 percent of those deductions immediately. Accelerating the restoration of the deductions is estimated to cost about $82 million over two years.

The Senate, however, also wants to add in other proposals as well.

One would exclude manufacturer cash rebates on cars sales from sales taxes at a cost of about $26 million over four years. Another would provide a state and local sales tax exemption for the sale of gold and silver coins.

They are also want to give a 50 percent state tax credit for anyone making a donation to the Ike Eisenhower Foundation in Abilene.

House and Senate Democrats on the conference committee were incredulous about how the state could afford a tax cut at this point in time.

They question not only whether a tax cut is feasible but whether the estimates – especially regarding corporate income repatriation – can be trusted.

They were even more skeptical since, as of Tuesday night, there still wasn’t language drafted for some elements of the tax bill such as the repatriation section.

“We don’t know the numbers. We need solid numbers, solid information,” said Democratic state Sen. Tom Sawyer, a member of the House negotiating team. “It’s ridiculous we’re moving this fast.”